All Hail King Whiskey

For the first time in nearly a decade, vodka isn't leading America's liquor sales.

After years of growth in the United States, vodka is slowing down. For the first time since the clear spirit took the sales crown in 2006, whiskey is projected to pass it this year, and widen the gap for years to come. It doesn’t appear to be a passing trend, but a serious and long-term shift in American consumer preferences.

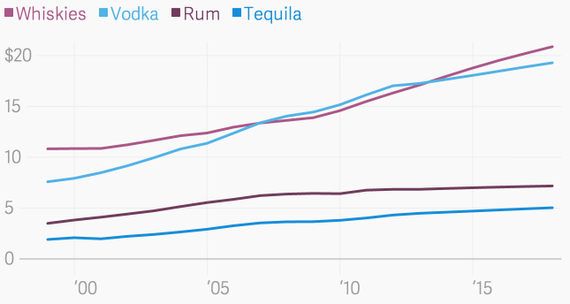

Vodka is still the volume king, meaning that more gallons of the stuff get sold every year, and that will continue for some time at least. But in dollar value, whiskey has made a big comeback:

Past and Projected Future U.S. Spirit Sales (billions)

That different products win out in value and volume says a lot.

Vodka managed to gain ubiquity in part because it’s inoffensive and inexpensive. It was a particular favorite of the baby-boomer generation and popular in the 1980s, as it wooed a premium market with fancy bottles and sophisticated marketing. Imported brands became lucrative. When that growth plateaued, flavored vodkas provided a big, but short-lived, gain.

Adding different flavors worked extraordinarily well for vodka companies in their heyday. Stalwart brands such as Smirnoff and Absolut expanded their offerings with citrus, chili, and cherry-flavored vodkas. Lesser-known entrants went wilder; Pinnacle Vodka has over 40 flavors, including Cinnabon, cotton candy, and birthday cake, while 360 Vodka offers double chocolate, Georgia peach, and buttered popcorn. Flavored vodkas made up less than 10 percent of sales in 2003 according to Euromonitor; now they are nearly a quarter.

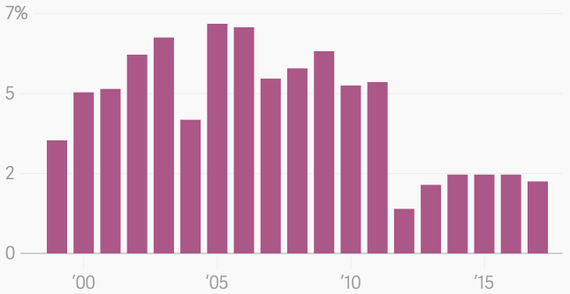

But that growth was only shoring up the vodka market's structural weakness. “They’ve reached the envelope sort-of as far as they can push it in terms of flavor innovations,” Euromonitor analyst Jared Koerten says. “So just in the last year we’ve seen growth slow down very significantly. In 2013 I think we’re looking at only 1 percent growth in vodka, which is a fifth of what it had been for the last five years in a row.”

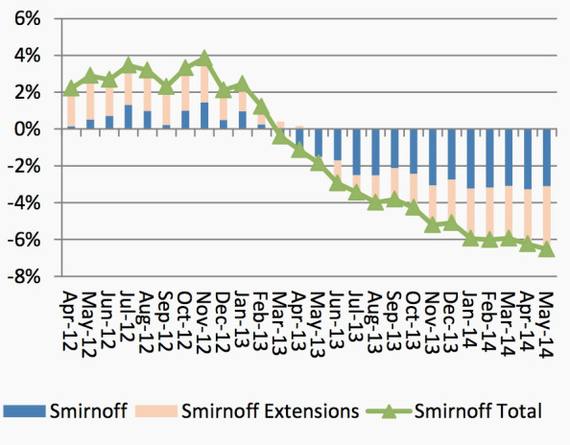

And last year, for the first time, there was evidence that flavored vodka wasn’t expanding the market, but cutting into unflavored sales. Smirnoff remains the biggest liquor brand out there in terms of volume, and its struggles in the past year-and-a-half are emblematic of vodka’s difficulties:

Rolling 12-month Volume Growth Breakdown

A recent Credit Suisse analyst note calls the shift away from vodka and towards whiskey a “generational rejection.” American consumers, it says, increasingly want something with “authenticity, heritage, and taste.” Vodka doesn’t provide that, and big-brand, ultra-sweet, flavored vodka least of all.

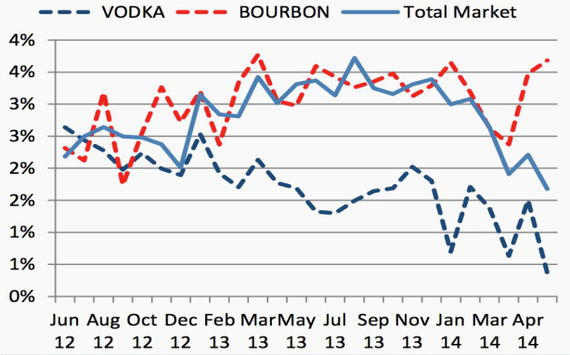

This is becoming evident in the pricing of vodka, which is falling relative to the overall liquor market while bourbon is rising:

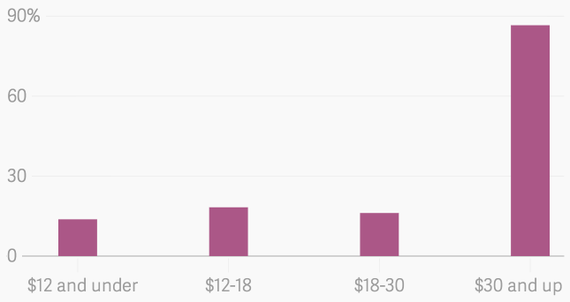

Part of the reason for bourbon’s overall price rise is the growing popularity of super-premium bourbon—whiskey priced at $30 per bottle and up, made in a manner similar to single-malt Scotch whisky, where each bottle is filled from a single aged barrel instead of being a blend of spirits. Buffalo Trace created the first such single-barrel bourbon in the 1980s, after bourbon had become commoditized. While big brands like Jim Beam have done wells with cheaper bourbons, the big out-performers of late have been pricey offerings like Woodford Reserve, and the more aged stuff is outgrowing “value” bourbons like Old Crow. Big brands have released smaller-batch aged products; bottles of Pappy Van Winkle can surpass some old Scotch single malts in price.

Growth in the U.S. Whiskey Market by Bottle, 2008-2013

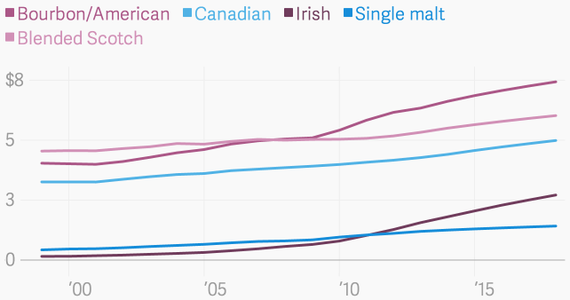

As a result, bourbons overall have been one of the fastest-growing parts of the whiskey market in the US (The other success story is Irish whiskey, thanks mostly to a strong marketing campaign for Jameson’s, aimed at younger drinkers in bars):

Past and Projected U.S. Sales of Whiskey (billions)

Still, despite their success in the premium market, whiskey makers aren’t shying away from populism either. As the vodka makers did, they’re trying to extend their reach by introducing flavored products.

There are whiskies flavored with cherries (Jim Beam’s Red Stag was the first big success), cinnamon, apples, and honey (paywall). Crown Royal joined the party in very Canadian fashion with its maple-flavored offering. There were 50 new flavored whiskey products in the first half of 2013 alone.

“I think [whiskies are] starting to hit this sort of trend that hit vodka years ago where they’re starting to expand their demographic with these sweeter-flavored products,” says Euromonitor’s Koerten. “It’s a wider group than your traditional bourbon consumer, younger drinkers who maybe haven’t developed a taste for bourbon, and women who tend to under index by a very wide margin when it comes to bourbon.”

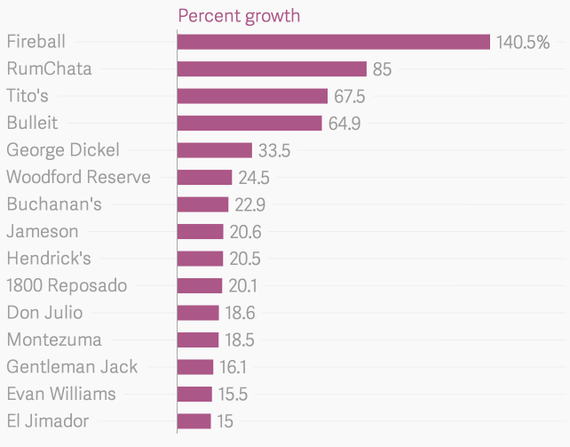

The biggest success has been Fireball, made by the Sazerac Company (which also owns Buffalo Trace and the Van Winkle brand). Euromonitor doesn’t track it as a whiskey due to its lower alcohol content, but it labels itself a cinnamon whiskey, and is at the top of Euromonitor’s list of the 15 fastest growing liquor brands of 2013 by volume. There’s only one vodka on the list, and, if you include Fireball, eight whiskies:

With distillers building capacity, socking away barrels, and opening new brands at a rapid clip, everything points to an expectation that growth in the US will continue for some years to come, as the country continues to reject beer in favor of liquor. The potential worldwide is even greater. Whiskey sales have outstripped vodka in value globally for years. By 2018, they’re projected to overtake vodka in liquid volume as well.